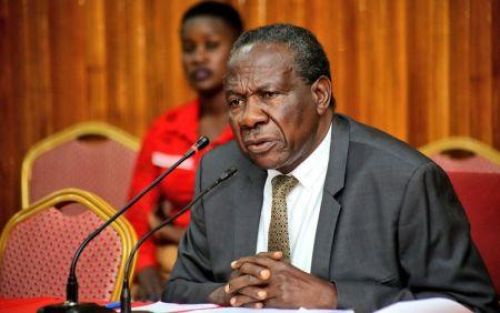

Uganda’s government, through Finance Minister Matia Kasaija, has received parliamentary approval to borrow €500 million (about US$567-568 million) to fund major infrastructure projects. Ecofin Agency+2The Uganda Daily+2

Here are the details, implications, and what it might mean for construction and development in Uganda.

Key Facts

- Amount: €500 million (≈ US$567-568 million) Ecofin Agency+2The Black Examiner+2

- Lenders involved:

- €270 million from Afreximbank Ecofin Agency+1

- €230 million provided jointly by Ecobank Uganda and the Development Bank of Southern Africa (DBSA) africaequity.net+3Ecofin Agency+3The Black Examiner+3

- Purpose: To fund infrastructure projects — transport, energy, road networks, etc. The Black Examiner+2Ecofin Agency+2

- Parliamentary approval granted: Despite concerns over the rising public debt. The Uganda Daily+2africaequity.net+2

- Context of debt: Uganda’s public debt increased by about 18% in 2024, reaching approximately US$29.1 billion. Ecofin Agency+1

Implications for Construction & Real Estate

This funding plan has several consequences relevant to people buying or developing building plans, contractors, and stakeholders in construction:

- Increased Infrastructure Projects

More funding for roads, bridges, energy supply, utilities, and transport means more demand for construction services. If you’re selling building plans, this could mean more business, especially in areas connected to infrastructure upgrades. - Better Access to Transportation & Utilities

When roads, power lines, water supply, and other infrastructure are improved, land in previously less accessible areas becomes more valuable. Buyers might prefer plots in such zones, increasing demand for plans in those regions. - Faster Permit Approvals (Potentially)

With government prioritizing infrastructure, there may be stronger regulatory and government attention. Projects tied to infrastructure might get streamlined processes, subsidies, or faster approvals. - Public Debt Concerns

Because the debt is rising, there might be tighter fiscal controls or caution in government spending. For construction, this could mean more scrutiny on costs, quality, and proper planning. Emphasizing compliance, realistic costing, and financial viability in your plans will become more important. - Opportunities for Private Developers

Infrastructure investments often open up peripheral land—areas outside city centers become more reachable. Developers who have compact, well-planned house plans could benefit by offering designs that take advantage of these newly connected zones.

What This Means for Smeaton Constructions & Customers

For your business and for clients looking to buy plans, here are opportunities and things to highlight:

- Offer house plans that consider infrastructure expansion – e.g. plans for plots near upcoming road or utility projects.

- Stress that your plans are compliant with regulations because new infrastructure funding usually comes with stricter oversight.

- Emphasize cost-efficiency and smart designs: with rising costs, buyers want value.

- Create content/blogs around how upcoming infrastructure funding will change land values, accessibility, etc. to attract leads who want to build in “emerging” zones.